TAP INTO THE FUTURE OF GOVERNMENT

Get the only non-profit intelligence of the defense, civilian, and federal IT markets

Released on Nov. 19, 2024 during the two-day Vision Conference

Federal IT Management and Budget

This team prepares an annual five-year budget forecast of the IT market for civil and defense sectors of the federal government, including an assessment of related plans, programs, and market topics that cover computers, telecommunication systems, and related products and services. The committee provides an overall analysis of the federal and IT budgets for various civil and defense agencies, looks at top-line dollars and trends, and then forecasts federal IT spending for the next five years. Included in this forecast is an assessment of the various agency Exhibit 53 submissions to the Office of Management and Budget (OMB). The effects of government administrative policies and procedures on the IT marketplace are determined in cooperation with government agencies, and a determination is made on essential facts and figures relating to the IT market.

Industry Outlook

This team takes a bird’s-eye view of the market through the lens of the financial & analyst community. Interviews include major financial institutions and analysts who cover government services companies. A wide range of topics are covered including the macro view of government acquisition & buying trends, implications of emerging technologies such as artificial intelligence, the environment for M&A and impact on the industry, and potential market disruptors such as non-traditional competitors. This “outside-in” perspective complements the other teams that are interviewing the government directly resulting in a 360 degree view of market dynamics.

Acquisition Trends

The Acquisition Trends Team will focus on one of the most dynamic aspects of Federal business – agency acquisition patterns – what are the trends for the Best-in-Class contracts, protests, AI, work site requirements, joint ventures, and small business contracting to name just a few hot topics. Understand how new policies and new acquisition initiatives will impact your bids and your business

Customer Experience

With today’s focus on improving government services, the Professional Services Council formed a Vision Forecast team to focus on citizen services and/or customer experience (CX). This team focuses on identifying the priorities and challenges agencies are having when improving services from the perspective of governance, strategy, performance measures, design thinking, culture, and customer research and understanding. Discussions are conducted with the Office of Management and Budget (OMB), agency customer experience and digital services teams, and IT staff. Improving government services has been a focus for several Administrations and has been implemented through guidance in Section 280 of OMB Circular A-11. The 21st Century Integrated Digital Experience Act (IDEA) was also passed in December 2018 to focus federal agencies on improving digital experiences by improving websites, digitizing forms and electronic signatures.

Federal IT Management and Budget

This team prepares an annual five-year budget forecast of the IT market for civil and defense sectors of the federal government, including an assessment of related plans, programs, and market topics that cover computers, telecommunication systems, and related products and services. The committee provides an overall analysis of the federal and IT budgets for various civil and defense agencies, looks at top-line dollars and trends, and then forecasts federal IT spending for the next five years. Included in this forecast is an assessment of the various agency Exhibit 53 submissions to the Office of Management and Budget (OMB). The effects of government administrative policies and procedures on the IT marketplace are determined in cooperation with government agencies, and a determination is made on essential facts and figures relating to the IT market.

Industry Outlook

This team takes a bird’s-eye view of the market through the lens of the financial & analyst community. Interviews include major financial institutions and analysts who cover government services companies. A wide range of topics are covered including the macro view of government acquisition & buying trends, implications of emerging technologies such as artificial intelligence, the environment for M&A and impact on the industry, and potential market disruptors such as non-traditional competitors. This “outside-in” perspective complements the other teams that are interviewing the government directly resulting in a 360 degree view of market dynamics.

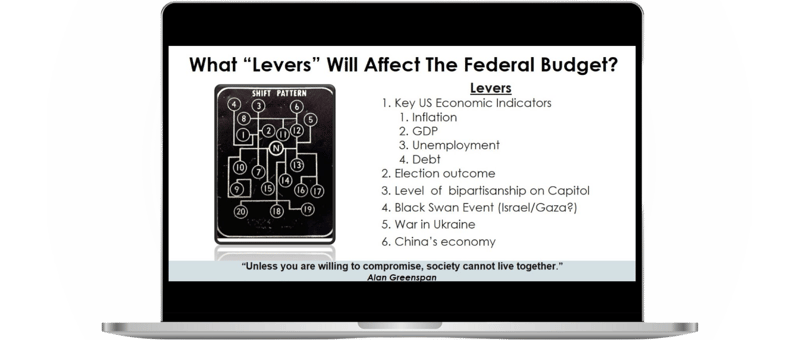

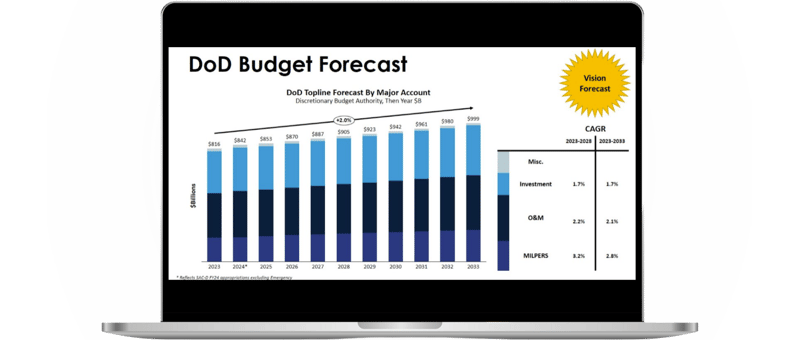

Macroeconomics & DoD Topline

This forecast team looks at the overall U.S. economic picture and develops a most likely scenario for federal discretionary spending, culminating in a defense topline forecast. It focuses on macroeconomic indicators, such as GDP growth, the federal deficit, debt/GDP ratio, and the interest rate environment. Its DoD Topline forecast is a ten-year forecast of defense budgets involving a top down look at the DoD budget by appropriation category (e.g. RDT&E, Procurement, O&M and Milpers). The forecast includes relevant information about current DoD activities such as defense strategy and planning, an estimate of the future force structure, an investment forecast, Supplemental spending, efficiency savings, and changing acquisition practices

Defense Reports

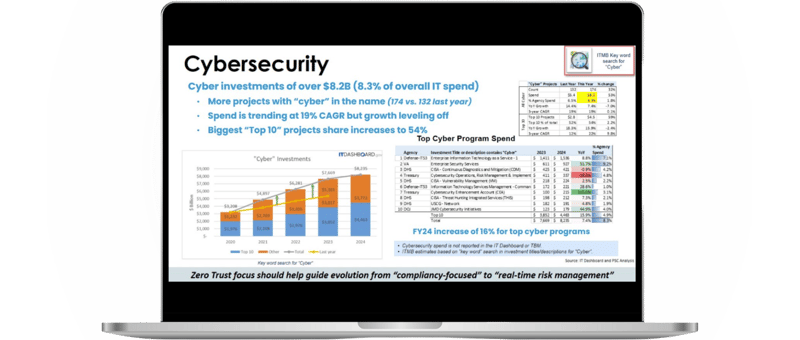

DoD IT & Cyber

This team prepares a forecast that analyzes the technology trends and dynamics related to Information Technology (IT) and Command and Control, Communications, Computers, Cyber, Intelligence, Surveillance, and Reconnaissance (C5ISR) systems in the Department of Defense. This study team takes a qualitative look at federal technology trends and assesses how these trends will impact future business opportunities for the Defense professional services industry. For example, the convergence of IT, mobile platforms, and cyber solutions creates opportunities for industry to deliver new capabilities to the Department of Defense. The team will also assess how technology is impacting government business processes, procurement of products and services, and Government’s willingness to embrace technology.

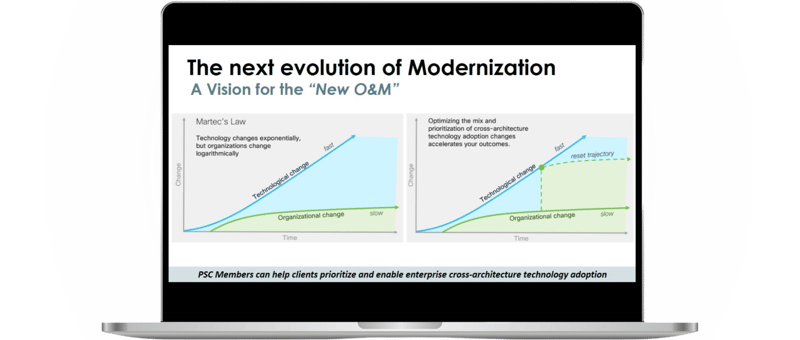

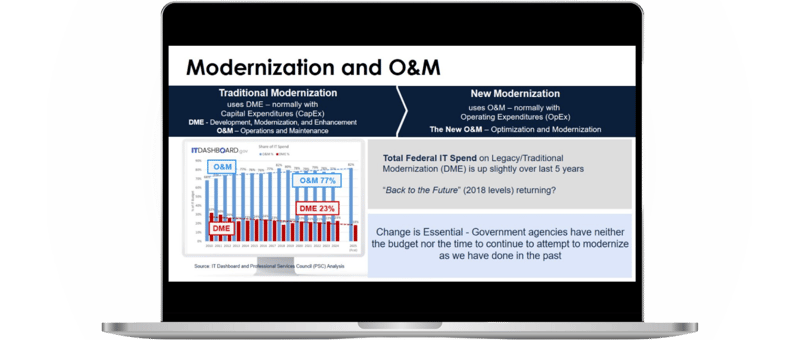

Defense Services

The DoD Services team provides an in-depth evaluation and analysis of the defense services sector including evolving DoD top-level support priorities and the cascading effects on the agencies and industry partners. The DoD Services Team addresses key elements of the defense services sector including budget adjustments and investments, introduction of enabling technologies such as AI, digital engineering, and digital modernization, O&M and sustainment challenges, and the implementation of customer experience. The report developed by this team provides an excellent understanding of these key trends as the DoD invests in new technologies and modernization.

Military Health

The Military Health System (MHS) Analysis Team conducts comprehensive evaluations and analyses tailored to the healthcare defense sector, focusing on the evolving priorities of the Department of Defense (DoD) Service, Health Affairs, and the Defense Health Agency and their impact on the health and readiness of the warfighter and their families. This team delves into critical aspects of healthcare services within the defense sector, including budget reallocations and strategic investments, the integration of cutting-edge technologies such as artificial intelligence (AI), digital transformation, and healthcare modernization initiatives. The team also tackles operational and maintenance (O&M) challenges, sustainment of workforce and healthcare services, and the enhancement of patient experience. The insights provided by this team’s report offer a profound understanding of these pivotal trends, as the MHS embraces innovative technologies and progresses towards comprehensive modernization.

Civilian Reports

Civilian Services

Federal Civilian Agencies differ significantly in their missions, budgets, constituencies etc. However, an in-depth examination of the Civilian Agency interviews by our Civilian Agency team of volunteers uncovers important commonalities amongst the Civilian sector. Understanding these commonalities is valuable for Vision attendees because business strategies, technical solutions, and acquisition approaches utilized by one agency can be potentially applicable to other Civilian agencies. For contractors, this means there is value in knowing what these similarities and trends are in order to help the Government solve common challenges more quickly and efficiently and to assist companies in potentially supporting their business growth from one Civilian agency account to another.

Dept. of Agriculture

This report will provide a comprehensive analysis of the Department of Agriculture, specifically focusing on objectives and priorities outlined within the agency mission. It addresses factors impacting their ability to execute this mission, such as: strategic plans, trends and drives, and outside influences. The report also includes an overview of the agency budget, including a discretionary and federal IT forecast, to help report holders and conference attendees identify future opportunities within the department. Further, the study findings will help you gain insight into key initiatives, programs and upcoming procurements, and agency technology needs.

Dept. of Commerce

This report will provide a comprehensive analysis of the Department of Commerce specifically focusing on objectives and priorities outlined within the agency mission. It addresses factors impacting their ability to execute this mission, such as: strategic plans, trends and drives, and outside influences. The report also includes an overview of the agency budget, including a discretionary and federal IT forecast, to help report holders and conference attendees identify future opportunities within the department. Further, the study findings will help you gain insight into key initiatives, programs and upcoming procurements, and agency technology needs.

Dept. of Energy

This report will provide a comprehensive analysis of the Department of Energy, specifically focusing on objectives and priorities outlined within the agency mission. It addresses factors impacting their ability to execute this mission, such as: strategic plans, trends and drives, and outside influences. The report also includes an overview of the agency budget, including a discretionary and federal IT forecast, to help report holders and conference attendees identify future opportunities within the department. Further, the study findings will help you gain insight into key initiatives, programs and upcoming procurements, and agency technology needs.

Dept. of Health & Human Services

This report will provide a comprehensive analysis of the Department of Health and Human Services, specifically focusing on objectives and priorities outlined within the agency mission. It addresses factors impacting their ability to execute this mission, such as: strategic plans, trends and drives, and outside influences. The report also includes an overview of the agency budget, including a discretionary and federal IT forecast, to help report holders and conference attendees identify future opportunities within the department. Further, the study findings will help you gain insight into key initiatives, programs and upcoming procurements, and agency technology needs.

Dept. of Homeland Security

This report will provide a comprehensive analysis of the Department of Homeland Security, specifically focusing on objectives and priorities outlined within the agency mission. It addresses factors impacting their ability to execute this mission, such as: strategic plans, trends and drives, and outside influences. The report also includes an overview of the agency budget, including a discretionary and federal IT forecast, to help report holders and conference attendees identify future opportunities within the department. Further, the study findings will help you gain insight into key initiatives, programs and upcoming procurements, and agency technology needs.

Dept. of Justice

This report will provide a comprehensive analysis of the Department of Justice, specifically focusing on objectives and priorities outlined within the agency mission. It addresses factors impacting their ability to execute this mission, such as: strategic plans, trends and drives, and outside influences. The report also includes an overview of the agency budget, including a discretionary and federal IT forecast, to help report holders and conference attendees identify future opportunities within the department. Further, the study findings will help you gain insight into key initiatives, programs and upcoming procurements, and agency technology needs.

Dept. of State

This report will provide a comprehensive analysis of the Department of State, specifically focusing on objectives and priorities outlined within the agency mission. It addresses factors impacting their ability to execute this mission, such as: strategic plans, trends and drives, and outside influences. The report also includes an overview of the agency budget, including a discretionary and federal IT forecast, to help report holders and conference attendees identify future opportunities within the department. Further, the study findings will help you gain insight into key initiatives, programs and upcoming procurements, and agency technology needs.

Dept. of Transportation

This report will provide a comprehensive analysis of the Department of Transportation, specifically focusing on objectives and priorities outlined within the agency mission. It addresses factors impacting their ability to execute this mission, such as: strategic plans, trends and drives, and outside influences. The report also includes an overview of the agency budget, including a discretionary and federal IT forecast, to help report holders and conference attendees identify future opportunities within the department. Further, the study findings will help you gain insight into key initiatives, programs and upcoming procurements, and agency technology needs.

Dept. of Treasury

This report will provide a comprehensive analysis of the Department of Treasury, specifically focusing on objectives and priorities outlined within the agency mission. It addresses factors impacting their ability to execute this mission, such as: strategic plans, trends and drives, and outside influences. The report also includes an overview of the agency budget, including a discretionary and federal IT forecast, to help report holders and conference attendees identify future opportunities within the department. Further, the study findings will help you gain insight into key initiatives, programs and upcoming procurements, and agency technology needs.

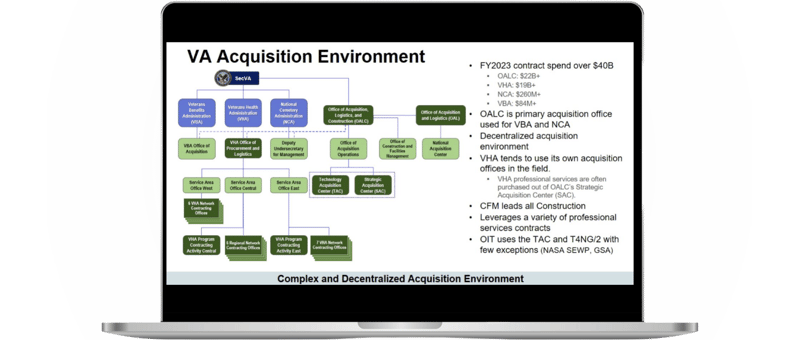

Dept. Of Veterans Affairs

This report will provide a comprehensive analysis of the Department of Veteran Affairs, specifically focusing on objectives and priorities outlined within the agency mission. It addresses factors impacting their ability to execute this mission, such as: strategic plans, trends and drives, and outside influences. The report also includes an overview of the agency budget, including a discretionary and federal IT forecast, to help report holders and conference attendees identify future opportunities within the department. Further, the study findings will help you gain insight into key initiatives, programs and upcoming procurements, and agency technology needs.

EPA

This report will provide a comprehensive analysis of the Environmental Agency, specifically focusing on objectives and priorities outlined within the agency mission. It addresses factors impacting their ability to execute this mission, such as: strategic plans, trends and drives, and outside influences. The report also includes an overview of the agency budget, including a discretionary and federal IT forecast, to help report holders and conference attendees identify future opportunities within the department. Further, the study findings will help you gain insight into key initiatives, programs and upcoming procurements, and agency technology needs.

NASA

This report will provide a comprehensive analysis of the National Aeronautics and Space Administration (NASA), specifically focusing on objectives and priorities outlined within the agency mission. It addresses factors impacting their ability to execute this mission, such as: strategic plans, trends and drives, and outside influences. The report also includes an overview of the agency budget, including a discretionary and federal IT forecast, to help report holders and conference attendees identify future opportunities within the department. Further, the study findings will help you gain insight into key initiatives, programs and upcoming procurements, and agency technology needs.

Released on Dec. 1, 2025 at the Vision Conference

Conference access, virtual sessions on Dec. 2-3, and on-demand presentations included with report purchase

About Vision

“The sessions have really helped me in putting together the correct strategy forward with the various client base that I have within government.”

– Director, Consulting, CGI

The Vision Federal Market Forecast includes 20+ in-depth reports on federal IT, defense and civilian budget trends, reform initiatives, drivers, and potential business opportunities.

The reports are a year-long culmination of research and non-attribution discussions with 400+ government leaders, think tank experts, Congressional staff and Wall street analysts conducted by vetted and trained industry.

The Vision Forecast is the only non-profit reporting of the defense, civilian, and federal IT markets. It is presented and organized by the PSC Foundation.

PSC Foundation Vision Forecast Purpose

- Provide a forum for the Federal marketplace to obtain a concise, quantifiable assessment of the budgets, programs, priorities, and issues in a rapidly changing environment

- Provide government customers the opportunity to express their current and future needs;

- Enable industry to understand and contribute to technology innovations, requirements development, upcoming opportunities, improved business practices and better customer relationships;

- Encourage greater government/industry communication and interchange on issues, technology, programs and other areas of mutual interest.

New for 2025! Attend a virtual mid-year preview of what study teams are hearing in their discussions with government leaders

Reports are released digitally during the annual Vision Conference, where research leads present report findings and government leaders comment on the results through keynotes and panel sessions.

Vision Federal Market Forecast Conference

Dec. 1, 2025 at the Westin in Arlington, VA

Virtual presentations on Dec. 2-3, and on-demand access included!

The Vision Conference marks the release of the 61st Annual Federal Market Forecast, 20+ in-depth reports on federal IT, defense and civilian agencies.

Join industry and government leaders to hear researchers present report findings and federal executives comment on the results through keynotes and panel sessions.

Conference Highlights

.png?width=250&height=250&name=On%20Demand%20(2).png) Keynote & Plenary Sessions

Keynote & Plenary Sessions Conference Mobile App

Conference Mobile App Q&A Time for Speakers

Q&A Time for Speakers On-Demand Access to Select Sessions

On-Demand Access to Select Sessions CEU & CLP Eligibly

CEU & CLP Eligibly  Buffet Lunch

Buffet Lunch Dedicated Networking Breaks

Dedicated Networking Breaks Post-event Happy Hour

Post-event Happy Hour And More!

And More!

Access to all conference plenary sessions and keynotes are included with your report purchase. You have the option of attending live on day one or watching sessions on-demand.

Featured Plenary Sessions

Keynote

The Vision Conference features civilian and defense government leaders each year. Check out the speaker page for the latest additions.

2025 Featured Speakers

The Honorable Michael Cadenazzi was sworn in as the Assistant Secretary of Defense for Industrial Base Policy (ASD(IBP)) on September 23, 2025. In this role, he is the principal advisor to the Under Secretary of Defense for Acquisition and Sustainment on industrial base policies and leads the Department of Defense's efforts to develop and maintain the U.S. defense industrial base to ensure a secure supply of materials critical to national security.

Over the past two decades, Mr. Cadenazzi has served as a serial entrepreneur and consultant with experience in managing and addressing challenging issues across the aerospace & defense sector. He has launched multiple defense industry services and technology start-ups across the signals intelligence, program analysis, data analytics, and market assessment and strategy sectors, and executed two successful transfers of business ownership. His extensive sector experience includes work from the space to undersea domains and from aircraft and munitions to armor, weapons, ships, and services. His clients have included domestic and international firms from large prime contractors to all levels in the supply chain. His direct experience spans strategy, mergers & acquisitions, operations, supply chain and organizational transformation.

Prior to his civilian career, Mr. Cadenazzi served for ten years as an active-duty U.S. Navy cryptologic warfare officer. He completed the Cryptologic Division Office Course at Corry Station in Pensacola Florida before his first tour at Naval Communications & Telecommunications Area Master Station (NCTAMS) WESTPAC in Agana, Guam. Following graduate education, he was assigned to the staff of Commander, U.S. Navy SIXTH Fleet in Gaeta Italy. He completed his military service on the staff of U.S. Naval Forces Europe in London, the United Kingdom.

Mr. Cadenazzi holds a bachelor’s degree in engineering from Tulane University and a master’s degree in electrical engineering with an emphasis on RF communications and signals intelligence from the U.S. Naval Postgraduate School. He was commissioned an ensign in 1995 through the Tulane Naval Reserve Officer Corps (NROTC) program.

Sean Fitzgerald serves as the Assistant Director for Cyber and Operational Technology (COT) within Homeland Security Investigations (HSI), the principal investigative component of the Department of Homeland Security. HSI investigates, disrupts, and dismantles transnational criminal organizations and terrorist networks that threaten or seek to exploit the customs and immigration laws of the United States. As the Assistant Director of COT, Mr. Fitzgerald manages information technology programs and initiatives that directly support HSI’s law enforcement mission, while driving significant advancements in technology to combat crime. In this role, he leads a combined workforce of over 600 employees and manages an annual budget of nearly $275 Million. He oversees the DHS Cyber Crimes Center, which leverages specialized technical resources and expertise to conduct transnational investigations into internet-related crimes. He also directs the HSI Innovation Lab, the agency’s centralized hub dedicated to developing next-generation analytics, tools, and business processes to enhance HSI operations. Additionally, Mr. Fitzgerald oversees Technical Operations, which equips the agency with cutting-edge electronic surveillance technologies, supporting criminal investigations and national security operations. This division also manages the Title-III and Linguistics Programs, law enforcement information sharing initiatives, and the delivery of critical data analysis and reporting to support HSI’s mission.

Prior to this assignment, Mr. Fitzgerald served as the Special Agent in Charge for Chicago, where he was responsible for overseeing investigative, analytical, and administrative operations throughout HSI Chicago’s area of responsibility, which included five offices and two posts of duty located throughout Illinois, Indiana, and Wisconsin. Before that, he was the Deputy Special Agent in Charge for HSI Chicago.

Mr. Fitzgerald began his federal law enforcement career as a Special Agent in Chicago in 2002. In 2010, he transferred to the Office of International Affairs and served as an HSI Representative with the HSI Attaché Mexico City. He returned to HSI Chicago in 2012 as the Group Supervisor for the Financial Investigations Group. Following 3 years of leading the group, he transitioned to serving as an Operations Manager within HSI Domestic Operations at Headquarters. He went on to serve in other capacities within Domestic Operations, including Special Assistant to the Deputy Assistant Director and Acting Operations Chief. In 2017, Mr. Fitzgerald was promoted to Assistant Special Agent in Charge for HSI Chicago. The division he oversaw included the Chicago Narcotics Group, the Undercover Operations Group, and the Financial Investigations Group. During his tenure, he also provided leadership to the Human Trafficking Group and the Organized Crime Drug Enforcement Task Force Strike Force Group.

Mr. Fitzgerald, a native of Illinois, earned a bachelor’s degree from Western Illinois University, Macomb, Illinois, in 1998.

Donald R. Stakes is the Acting Deputy Executive Assistant Commissioner of the Office of Field Operations (OFO), U.S. Customs and Border Protection (CBP). As part of his role, he leads over 34,000 employees and oversees an annual operating budget of $7.5 billion at 328 U.S. ports of entry and numerous programs to support OFO’s national and economic security mission.

Mr. Stakes most recently served as the Executive Director (XD), Mission Support, OFO. As XD, he oversaw critical administrative and operational support for personnel across all OFO field offices, ports of entry, the National Targeting Center, Headquarters, and international duty stations.

Previously, Mr. Stakes was the Acting Director of Field Operations for the Buffalo Field Office where he led over 1,500 employees. He oversaw all port operations across New York State (excluding New York City), which includes 16 land border crossings, 4 rail crossings, 12 regional airports, 4 seaports, numerous small boat reporting stations, and the Industrial and Manufacturing Materials Center of Excellence and Expertise.

Mr. Stakes has furthered the business operations and mission of OFO by establishing numerous mission support programs. He established the National Integrity and Accountability Center (NIAC) to centralize analytics, case management, and communications — promoting integrity and expediting accountability. He also expanded the use of the Robotics Process Automation to improve audit efficiency for OFO’s public-private partnerships. Additionally, he implemented the OFO Position Prioritization Process as a transparent, recurring process to provide an enterprise-wide view of manpower requirements and organizational changes.

Throughout his career, Mr. Stakes has served in various leadership positions, including the Deputy Executive Director, Mission Support; Assistant Director, Field Operations, Laredo Field Office; Director, Labor Relations, Office of Human Resources Management; and CBP’s Chief Labor Negotiator during collective bargaining with the National Treasury Employees Union.

Mr. Stakes has a bachelor’s degree in Human Services from Elon University. He completed the Negotiation and Leadership Program at Harvard University in 2013 and is a 2015 graduate of the CBP Leadership Institute.

2025 Visionary Sponsors

2025 Vision Conference is now elidable for CEU & CLP credits. To learn more visit our FAQ page.

2025 Agenda

December 1, 2025 Day 1

.png?width=90&height=90&length=90&name=Finelli%20(1).png)

This panel will explore how the Department of Homeland Security is navigating a transformative period fueled by the significant influx of resources from the “Big Beautiful Bill.” Senior leaders will discuss how this funding is enabling mission execution, shaping procurement strategies—including the use of innovative contracting methods such as OTAs and CSOP—and driving identified operational efficiencies. Panelists will examine evolving approaches to the border security mission, with emphasis on strengthened coordination with the Department of Defense, as well as state and local partners. The discussion will also address the human side of change, including workforce strategies during rapid transformation. Finally, the session will highlight opportunities for industry to align with DHS’s new operational paradigm, fostering partnerships that deliver greater agility, effectiveness, and mission success.

December 2, 2025 Day 2

Our Military Health System (MHS) Analysis Team conducts comprehensive evaluations and analyses tailored to the healthcare defense sector, focusing on the evolving priorities of the Department of Defense (DoD) Service, Health Affairs, and the Defense Health Agency and their impact on the health and readiness of the warfighter and their families. Our team delves into critical aspects of healthcare services within the defense sector, including budget reallocations and strategic investments, the integration of cutting-edge technologies such as artificial intelligence (AI), digital transformation, and healthcare modernization initiatives. The team also tackles operational and maintenance (O&M) challenges, sustainment of workforce and healthcare services, and the enhancement of patient experience.

The National Aeronautics and Space Administration presentation will focus on providing information on agency initiatives. Emphasis will be on strategic plans, procurements and programs, technologies, trends and drivers, and outside influences.

In this session, our moderator will lead a candid discussion with industry leaders on how organizations adapted to these disruptions: what strategies worked, what lessons were learned, and how the contracting landscape is evolving as agencies reset for 2026. The conversation will also explore the long-term impacts on workforce stability and partnership between government and industry.

Attendees will gain insight into:

- How companies navigated abrupt program cancellations and funding pauses

- The effects of shifting priorities and organizational changes within key agencies

- Practical steps to build resilience amid ongoing fiscal and operational uncertainty

- Join us for a forward-looking discussion that unpacks 2025’s challenges and the path toward a more stable, strategic federal marketplace.

December 3, 2025 Day 3

This report will provide a comprehensive analysis of the Department of Homeland Security, specifically focusing on objectives and priorities outlined within the agency mission. It addresses factors impacting their ability to execute this mission, such as: strategic plans, trends and drives, and outside influences. The report also includes an overview of the agency budget, including a discretionary and federal IT forecast, to help report holders and conference attendees identify future opportunities within the department. Further, the study findings will help you gain insight into key initiatives, programs and upcoming procurements, and agency technology needs.

.png?width=90&height=90&length=90&name=smith%20(2).png)

The Department of Justice team will look at topics focused on providing in-depth information on DOJ initiatives and opportunities. Emphasis will be on strategic plans, procurements and programs, technologies, trends and drivers, the political landscape, co-agency initiatives/roles, and outside influences.

This report will provide a comprehensive analysis of the Department of Energy, specifically focusing on objectives and priorities outlined within the agency mission. It addresses factors impacting their ability to execute this mission, such as: strategic plans, trends and drives, and outside influences. The report also includes an overview of the agency budget, including a discretionary and federal IT forecast, to help report holders and conference attendees identify future opportunities within the department. Further, the study findings will help you gain insight into key initiatives, programs and upcoming procurements, and agency technology needs.

This report will provide a comprehensive analysis of the Department of Transportation, specifically focusing on objectives and priorities outlined within the agency mission. It addresses factors impacting their ability to execute this mission, such as: strategic plans, trends and drives, and outside influences. The report also includes an overview of the agency budget, including a discretionary and federal IT forecast, to help report holders and conference attendees identify future opportunities within the department. Further, the study findings will help you gain insight into key initiatives, programs and upcoming procurements, and agency technology needs.

This report will provide a comprehensive analysis of the Environmental Agency, specifically focusing on objectives and priorities outlined within the agency mission. It addresses factors impacting their ability to execute this mission, such as: strategic plans, trends and drives, and outside influences. The report also includes an overview of the agency budget, including a discretionary and federal IT forecast, to help report holders and conference attendees identify future opportunities within the department. Further, the study findings will help you gain insight into key initiatives, programs and upcoming procurements, and agency technology needs.

.png?width=90&height=90&length=90&name=puckace%20(2).png)

Federal Civilian Agencies differ significantly in their missions, budgets, constituencies etc. However, an in-depth examination of the Civilian Agency interviews by our Civilian Agency team of volunteers uncovers important commonalities amongst the Civilian sector. Understanding these commonalities is valuable for Vision attendees because business strategies, technical solutions, and acquisition approaches utilized by one agency can be potentially applicable to other Civilian agencies. For contractors, this means there is value in knowing what these similarities and trends are in order to help the Government solve common challenges more quickly and efficiently and to assist companies in potentially supporting their business growth from one Civilian agency account to another.

With the excellent market analysis and intelligence offered during the 2025 Vision Federal Market Forecast Conference, the only strategic question remaining must be: What now?

PSC President Stephanie Sanok Kostro will offer key insights regarding the federal marketplace in fiscal year 2026 and beyond. The executive branch has secured full-year appropriations for a handful of departments and programs (e.g., SNAP, military construction, veterans programs) while the rest of the government works under a Continuing Resolution that expires on January 30, 2026—raising the specter of another (albeit partial) government shutdown in early 2026. Meanwhile, the Pentagon has rolled out a massive effort to transform requirements, acquisition, and foreign sales processes; civilian agencies may benefit from some contracting reforms included in the National Defense Authorization Act for Fiscal Year 2026; and the flurry of contract terminations and stop work orders seems to have abated.

Attend this session and learn what these moving pieces mean for your business strategy and contract opportunities going forward.

Released on Dec. 1-3 during the three-day Vision Conference

Access Included with Report Purchase